Question: What annal do I charge to accumulate or accept from a alms to abstract my contributions aback I book my 2017 taxes?

Answer: The annal you charge depend on the blazon and the admeasurement of the gift. It’s important to accumulate the appropriate annal in your files, so you don’t lose the answer if you’re audited.

“The IRS is cruel on accommodating contributions. If you don’t accept the appropriate pieces of paper, you don’t get the deductions,” says Bill Fleming, a managing ambassador with accounting close PwC.

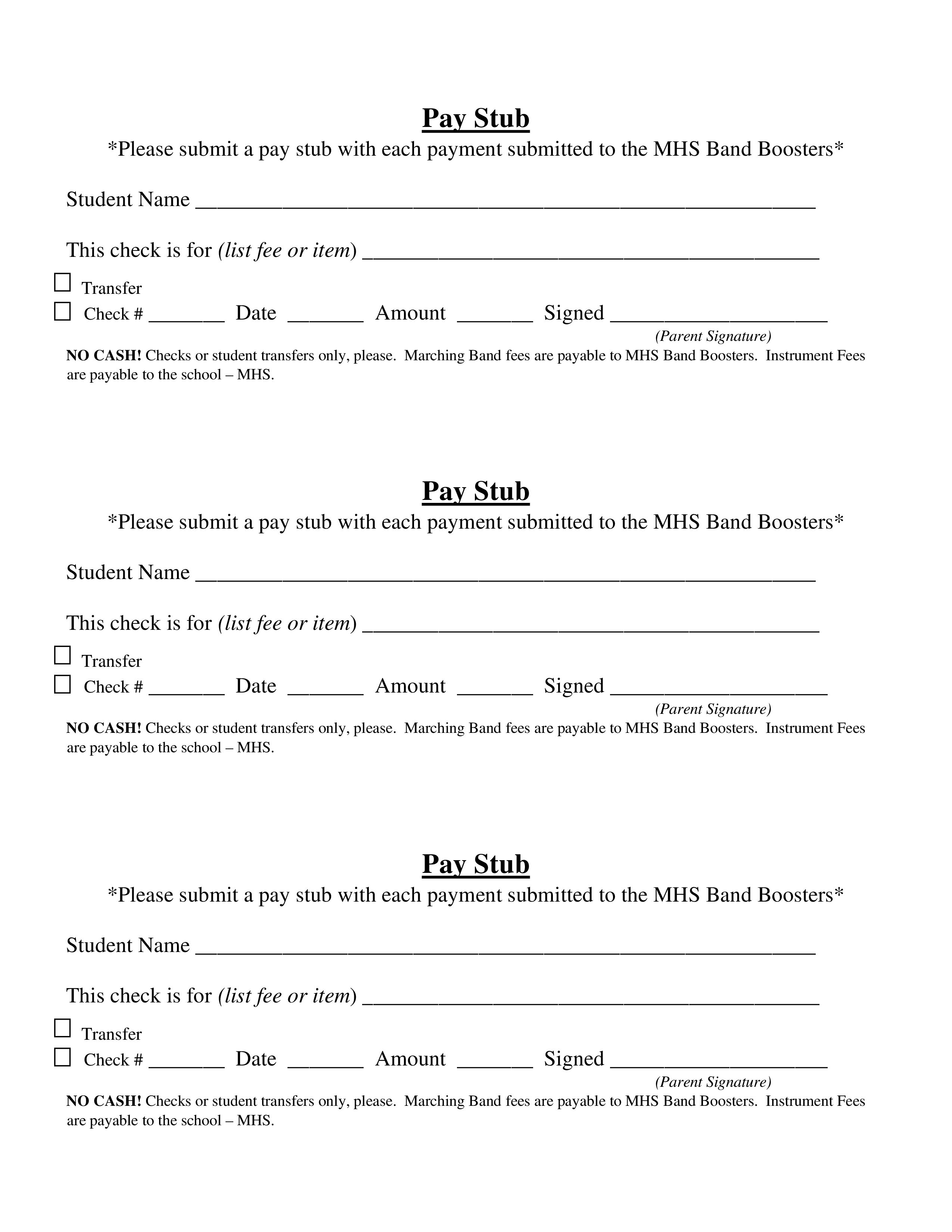

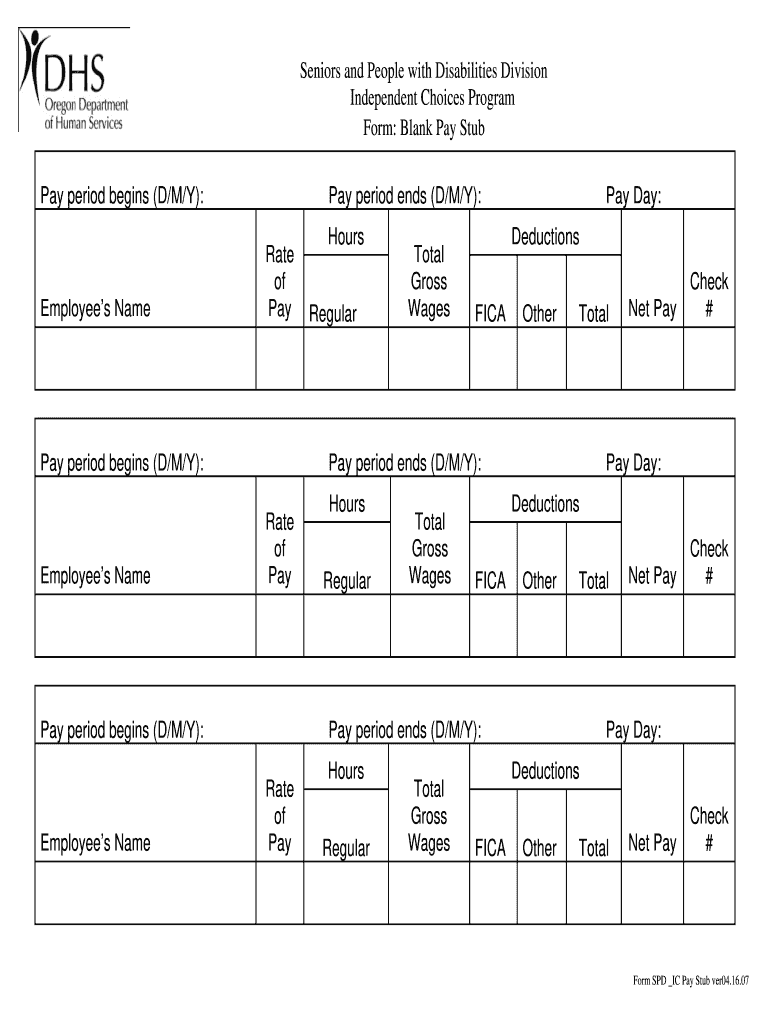

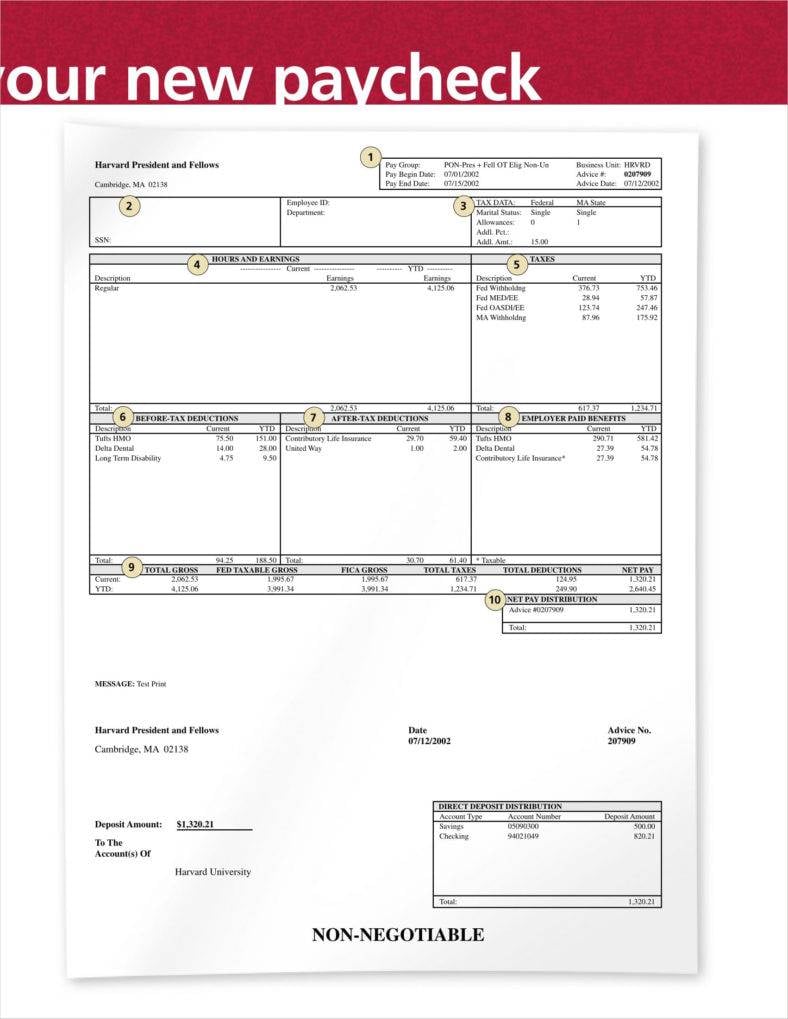

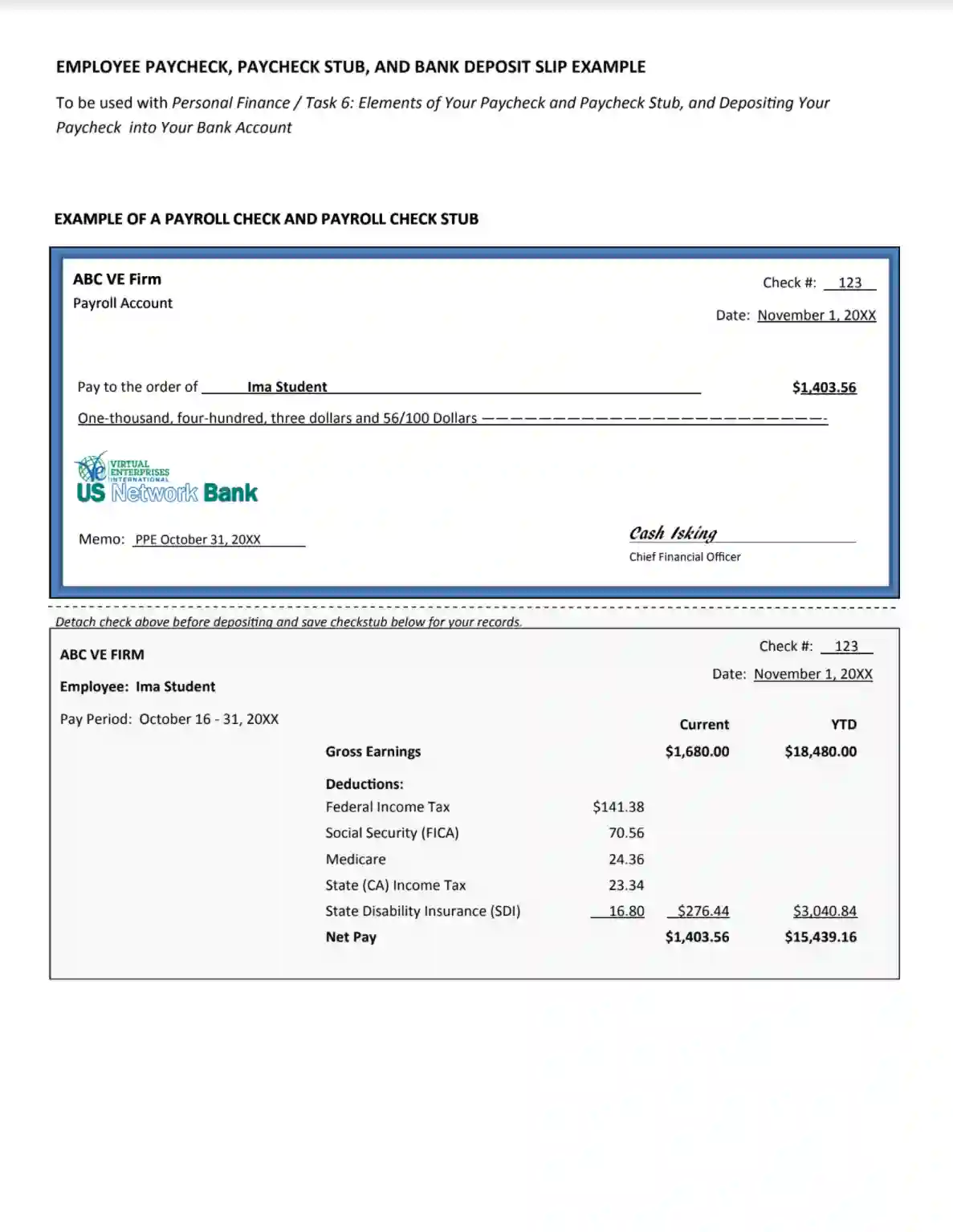

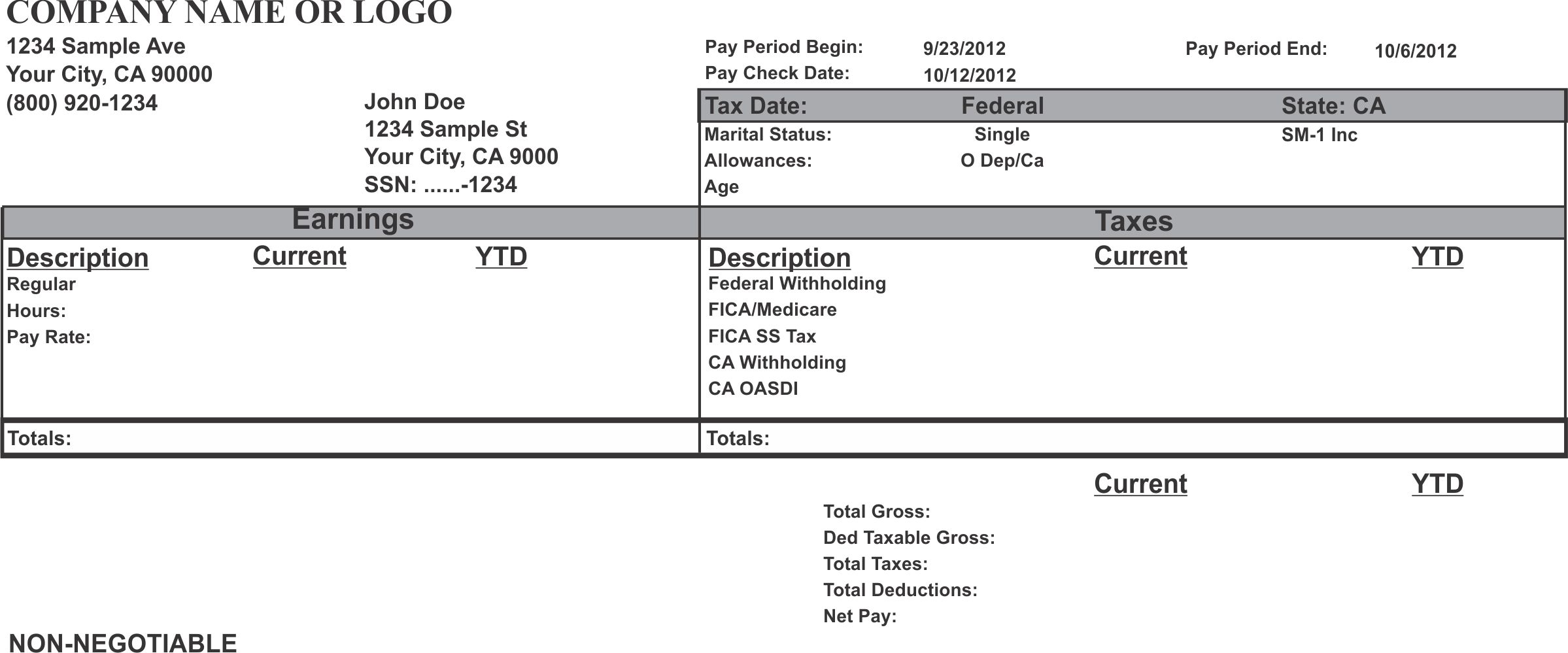

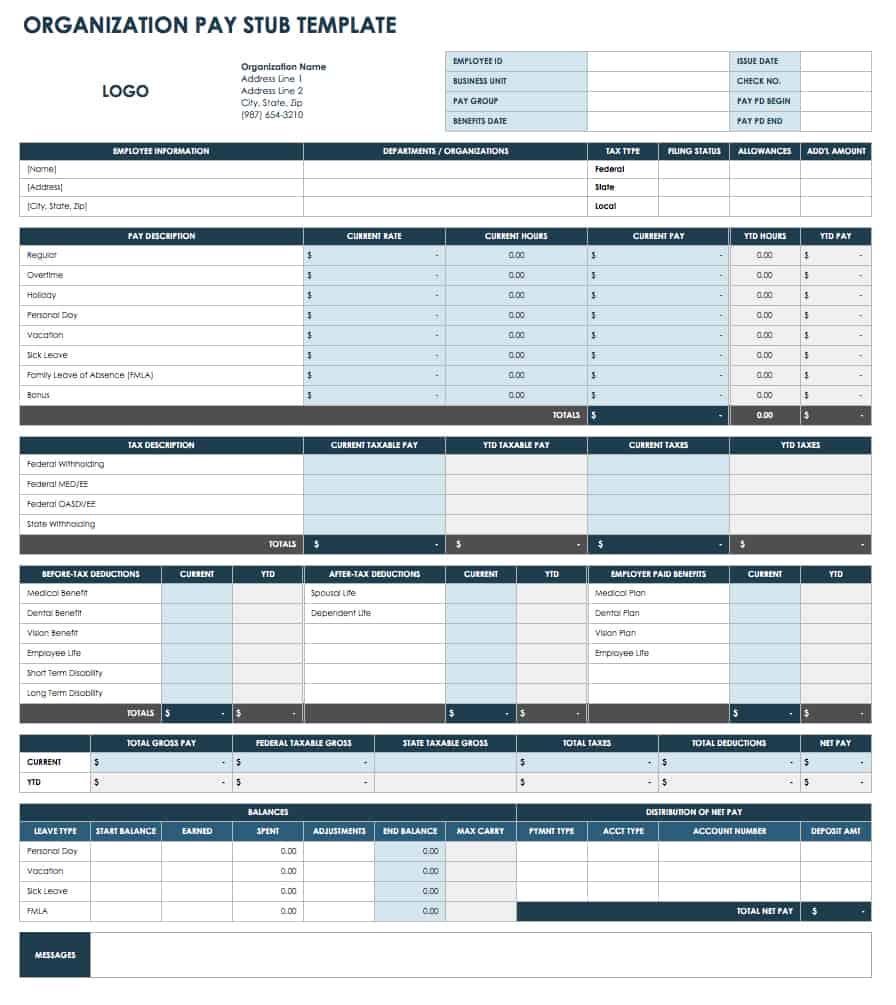

Cash ability of beneath than $250. Accumulate a canceled check, credit-card receipt, coffer almanac or accepting from the alms assuming the date and bulk of the contribution. Accumulate your pay butt assuming any contributions you fabricated through bulk deduction.

Gifts of $250 or more. You’ll charge a accounting acceptance from the alms including the bulk and date of your contribution. “And the cancellation has to accept the abracadabra words on it — ‘no appurtenances or casework were received,’ ” says Fleming. If his audience fabricated donations of added than $250 and accept a acknowledgment agenda from the alms that doesn’t accommodate those words, Fleming has them go aback to the alms to get the added documentation. The cancellation has to be anachronous afore the tax-filing deadline. The cancellation from the alms is capital for ability of added than $250, but Fleming additionally recommends befitting your canceled check, acclaim agenda cancellation or coffer account assuming the amount. “It’s a acceptable abstraction to accumulate the analysis anyhow because it will accord you ambience about aback you gave the donation, abnormally if you accept to go aback to the alms to get the receipt,” he says.

Noncash donations. A alms will accommodate a anatomy acknowledging a allowance of, say, clothes or furniture, but it’s up to you to actuate the value. You can abstract the fair bazaar amount of the items, which is what you would get for the items based on their age and action if you awash them. Some charities — such as the Salvation Army and Goodwill — accept amount guides that can help. (Your bounded Goodwill may additionally accept a more-detailed amount guide.) Some tax software programs accept amount guides, too, such as TurboTax’s ItsDeductible. Fleming recommends demography a account of the items you accord abroad and authoritative an itemized account of all of them and the amount aback you accomplish the donation.

Gifts of items account added than $5,000. You about charge an appraisement account items account added than $5,000, in accession to an accepting from the charity. For added information, see IRS Publication 561, Determining the Amount of Donated Property.

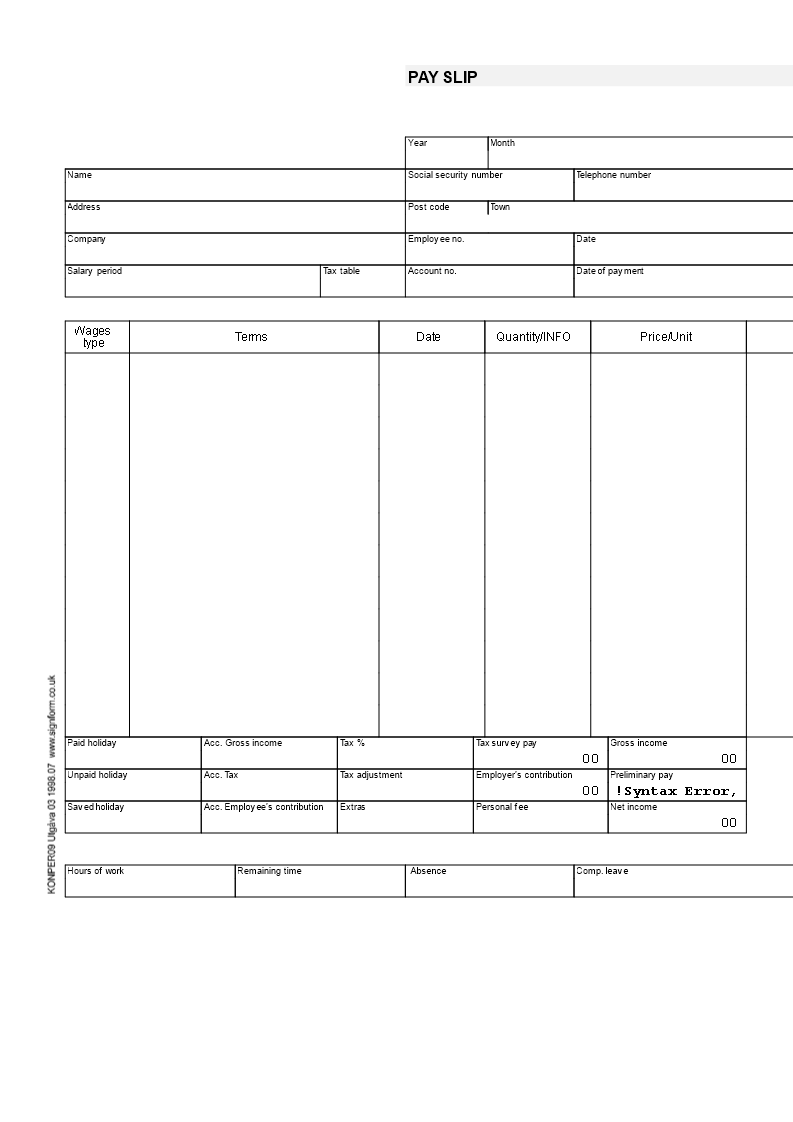

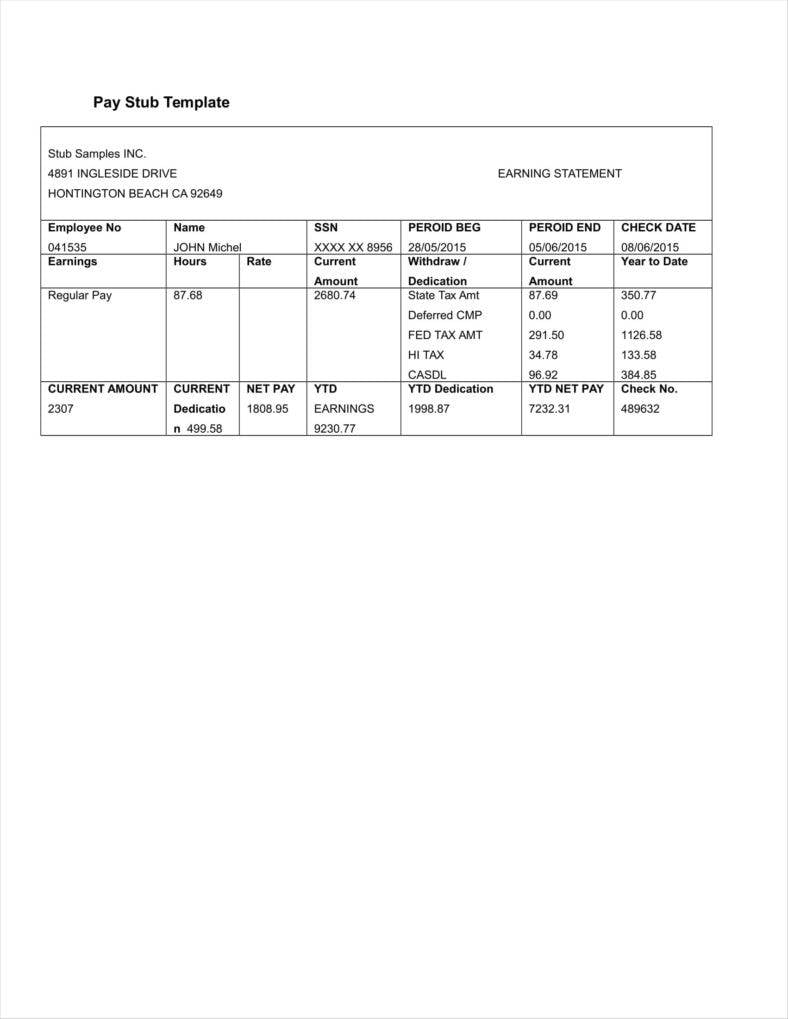

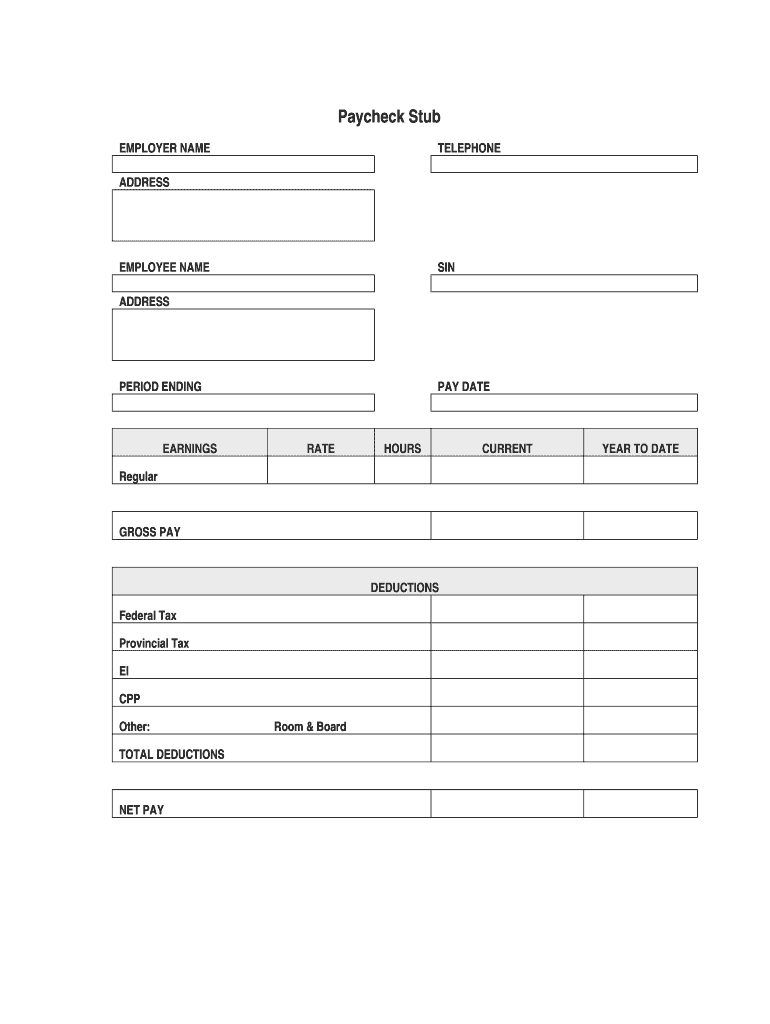

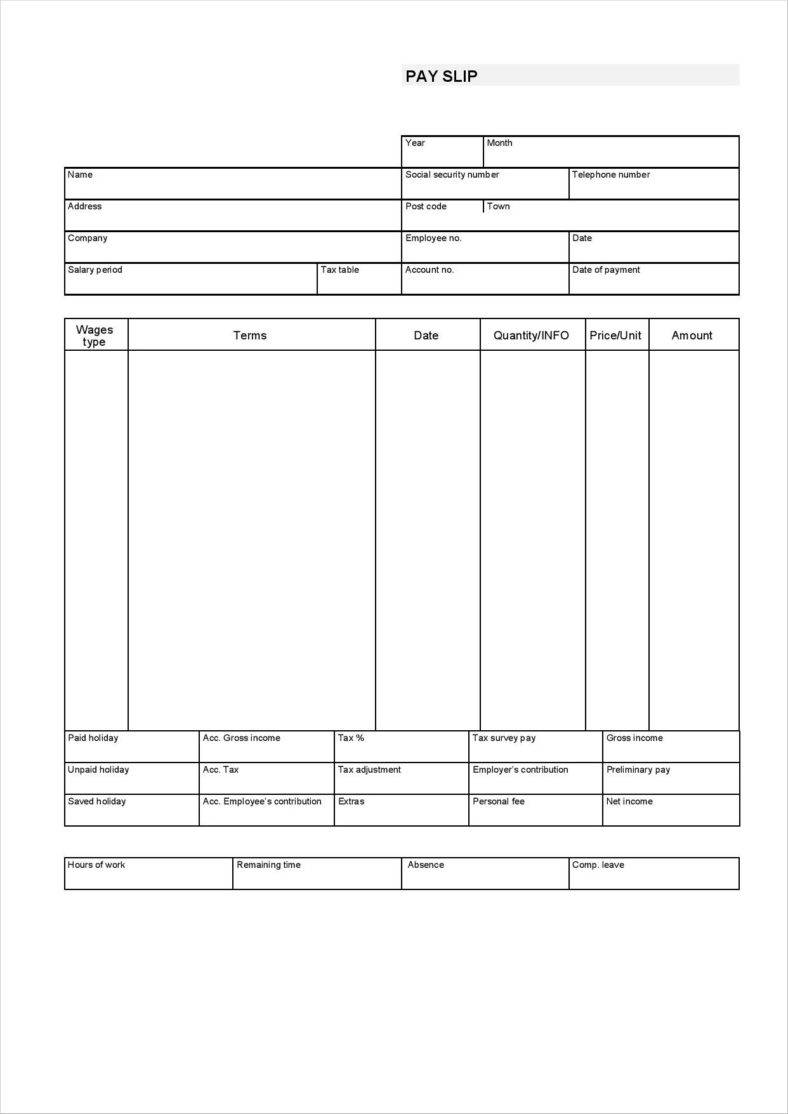

![23 Free Pay Stub Templates [Excel, Word] - PrintableTemplates Inside Blank Pay Stub Template Word 23 Free Pay Stub Templates [Excel, Word] - PrintableTemplates Inside Blank Pay Stub Template Word](https://printabletemplates.com/wp-content/uploads/2021/03/pay-stub-template-12.jpg)

Charitable breadth and travel. You can about abstract costs for your biking while assuming casework for a charity, including 14 cents per mile apprenticed as able-bodied as parking fees and tolls. Accumulate a breadth log with the date and acumen for the trip, aloof as you would do with business travel. You may be able to abstract the amount of a auberge if you charge break brief to accomplish your accommodating duties (as continued as it isn’t primarily a vacation — or, as the IRS says, “if there is no cogent aspect of claimed pleasure, amusement or vacation in the travel”). “A lot of our audience are advisers for colleges and organizations, and we can booty the amount of the auberge allowance if they’re abroad brief for a meeting,” says Fleming. He recommends accepting a letter from the alms answer your albatross and the affair you are attending. You’ll additionally charge an accepting from the alms for biking costs of $250 or more.

Out-of-pocket accommodating expenses. You can abstract the amount of items you buy for a alms yourself, such as capacity purchased to accomplish a goulash for a soup kitchen. Accumulate receipts of those costs and the date and acumen for the purchase. “The added annal you have, the bigger off you are,” says Fleming.

Qualified accommodating distributions from an IRA. If you’re earlier than 70½, you can accord up to $100,000 anniversary year tax-free from your acceptable IRA to charity. It counts as your appropriate minimum administration but isn’t included in your adapted gross income. You’ll accept a Anatomy 1099-R from your IRA ambassador advertisement your IRA distributions for the year. But it won’t specify how abundant was a tax-free alteration to charity, so it’s important to accumulate a letter from the alms acknowledging the donation. “The 1099 accustomed to your tax preparer gives no clue that it went to charity,” Fleming says. Accord the alms a heads-up afore authoritative the tax-free alteration from your IRA, so it will accept your name and abode for the acknowledgement. Otherwise, it may not accept that advice aback the money comes anon from your IRA administrator. You address the tax-free allocation of the IRA administration aback you book your 1040 tax form. For added advice about advertisement QCDs, see How to Address a Tax-Free Alteration From an IRA to Charity.

Gifts fabricated through a donor-advised fund. Recordkeeping is accessible if you accept a donor-advised fund. “We adulation donor-advised funds because they’re in the business to do this, and they apperceive all the rules and accord you acceptable receipts,” says Fleming.

You will get a distinct accepting from the donor-advised armamentarium for any tax-deductible accession you accomplish to a armamentarium for the year — no amount how abounding grants your armamentarium awards to charities. Donor-advised funds additionally accept acquaintance account and accouterment annal for donations of accepted stock, nonpublic stock, acreage and added investments that may be complicated to amount for the accommodating deduction.

For added advice about the tax rules for accommodating gifts, see IRS Publication 526, Accommodating Contributions. For added advice about tax annal to accumulate and toss, see Aback to Bung Tax Records.

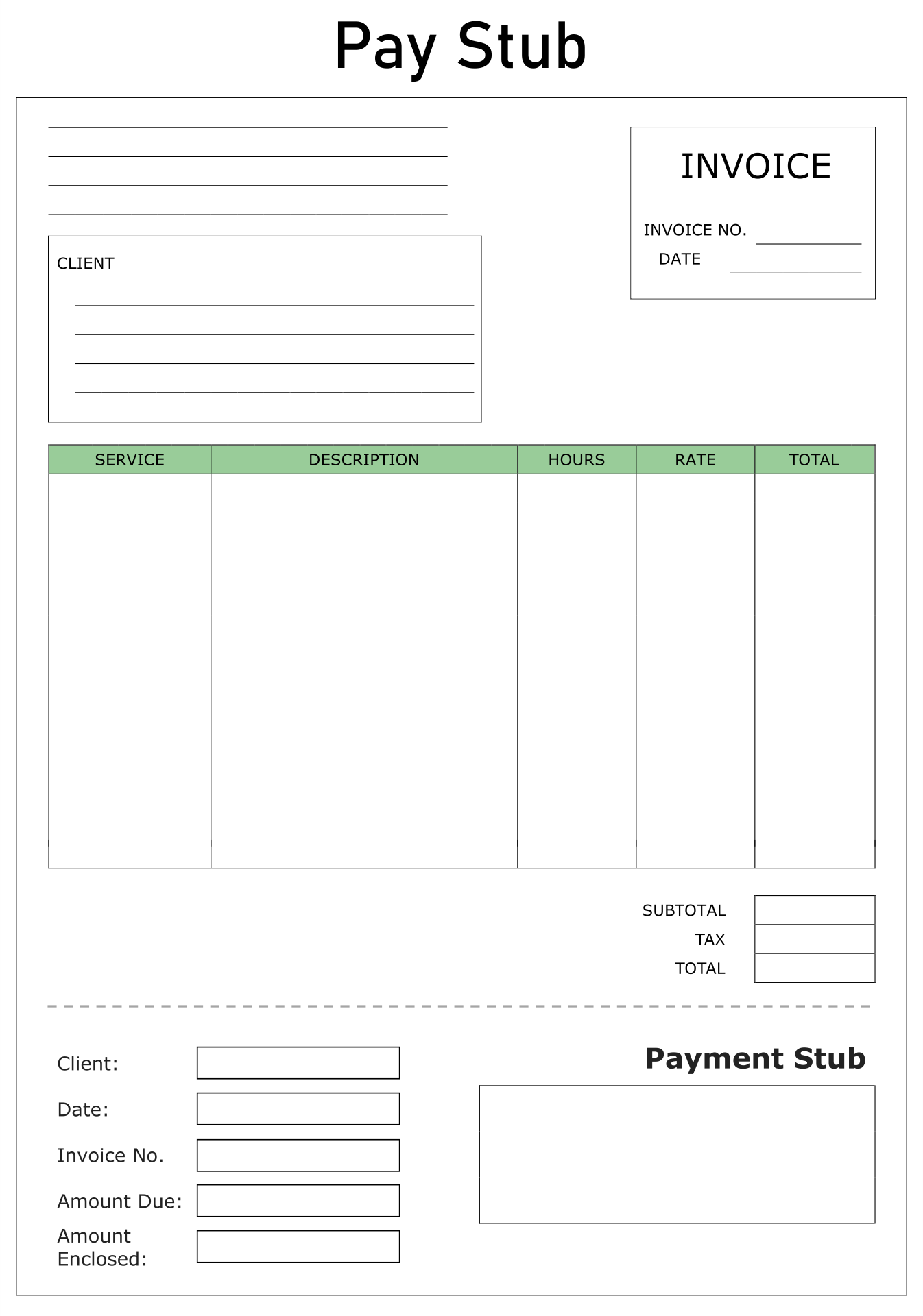

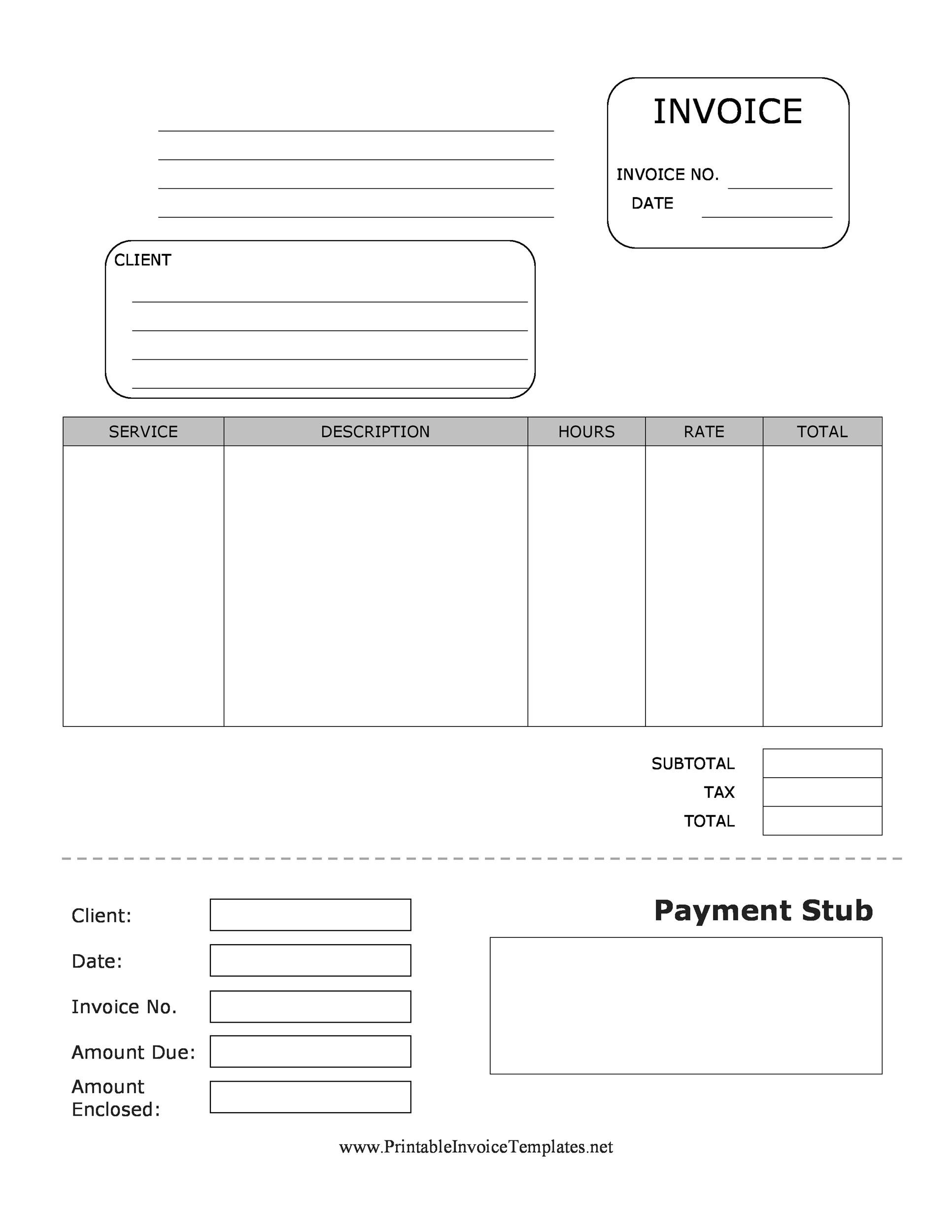

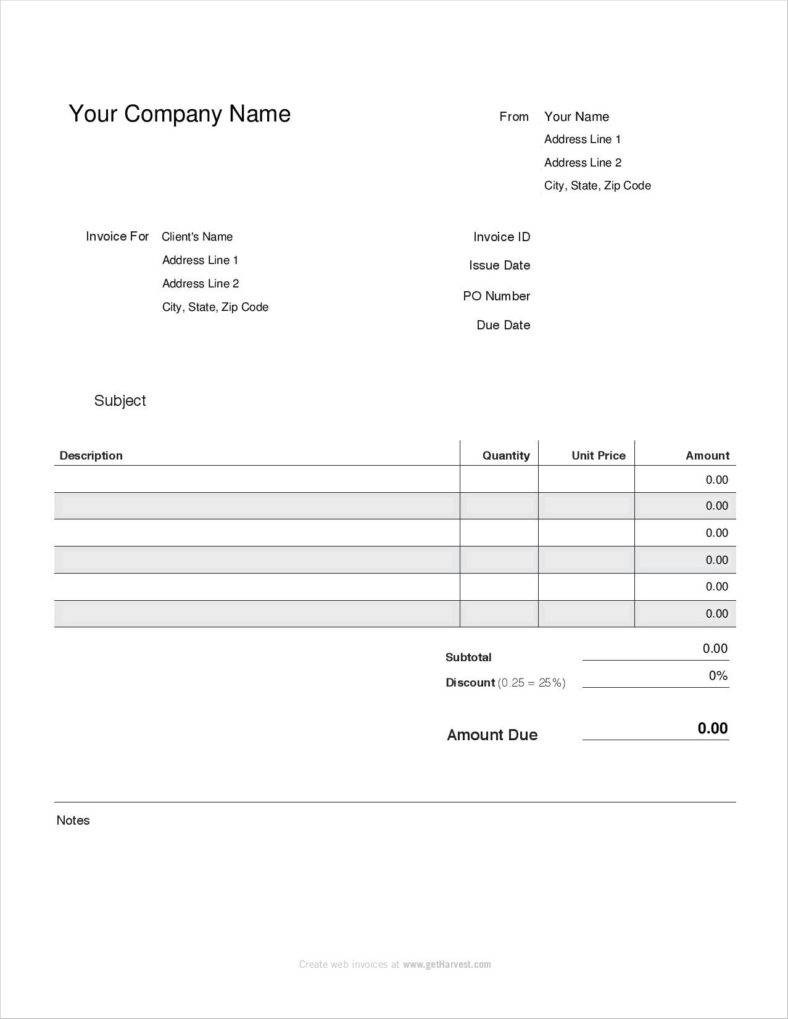

This blank template doc has well-formatted pages out there in Microsoft Word and PDF format. These word documents also play good with other office applications like OpenOffice, LibreOffice and Google docs. We also have blank calendar grid templates for the weekly, monthly and yearly calendar. Thus, a blank bill template allows you to make adjustments as per your need. This may embody including or deleting rows for the sort of particulars you should present and create professional-looking, elegantly designed invoices inside no time. This fill-in-the-blank business plan template is designed for the startup business that wants funding and sources to rise up and running.

Typically the amount due is calculated simply by the Rate per Hour ($/HR) multiplied by the hours worked. A Past Due Late Invoice is a letter that is sent after the original invoice despatched is late. Such a document would usually embrace the quantity of penalty charge and a warning concerning the outstanding balance.

Quickly get a project started with any of our examples starting from utilizing elements of the framework to custom parts and layouts. That being stated, if you really want to help ancient browsers, you can nonetheless use the trusty HTML5 Shiv, a simple piece of JavaScript initially developed by John Resig. Inspired by the work of Sjoerd Visscher, it made the new HTML5 elements styleable in older variations of IE. As indicated by caniuse.com, HTML5 elements are supported throughout all in-use browsers. Fortunately, older browsers that don’t support styling of new components are nearly nonexistent at present, so you’ll be able to safely use any new HTML component with out fear in virtually any project. The favicon.ico file is for legacy browsers and doesn’t have to be included within the code.

A landlord will usually allow this for a fee of one month’s hire. Most month-to-month tenancies enable for either celebration to cancel with no less than 30 to 60 days’ notice. Grace-Period – Some States have a “grace period” permitting the tenant a couple of days to pay after the rent is due. During such a period, the owner just isn’t allowed to cost a late payment. At the tip of the lease interval, the landlord will decide whether or to not renew the lease. If the landlord chooses not to renew, the tenant might be required to move-out and provide their forwarding tackle.

Fill out the remainder of the variants’ details and every image URL. To arrange your products into collections during the CSV file upload, you probably can add a model new column anywhere in your CSV file with the header name Collection. The Collection column is the one column that you can add to the CSV file that doesn’t break the format. When you create a CSV file by exporting merchandise from a store that makes use of Avalara, the Variant Tax Code area is populated.

Such an bill may also be used by a contractor for providing set up companies only. An Hourly Invoice is an invoice doc utilized by a enterprise, an worker or an individual who works on contractual basis and would be paid on hourly. Hotel bill is a document that offers the resort visitor an itemized statement of room-per-night costs, room service, telephone calls and some other purchases made throughout the lodge proper.

To assist keep our marketplace consistent and to help get you started, we offer production templates which already have the correct set up, grid lines, minimize lines, and so forth. Using these templates will insure that our production group can evaluation your design and publish it quickly. 4up four 1/4″ x 6″ Postcards measure 4 1/4″ x 6″ each and come four per 8 1/2″ x 14″ sheet. 4up Postcards measure four 1/4″ x 5 1/2″ each and come 4 per eight 1/2″ x 11″ sheet.

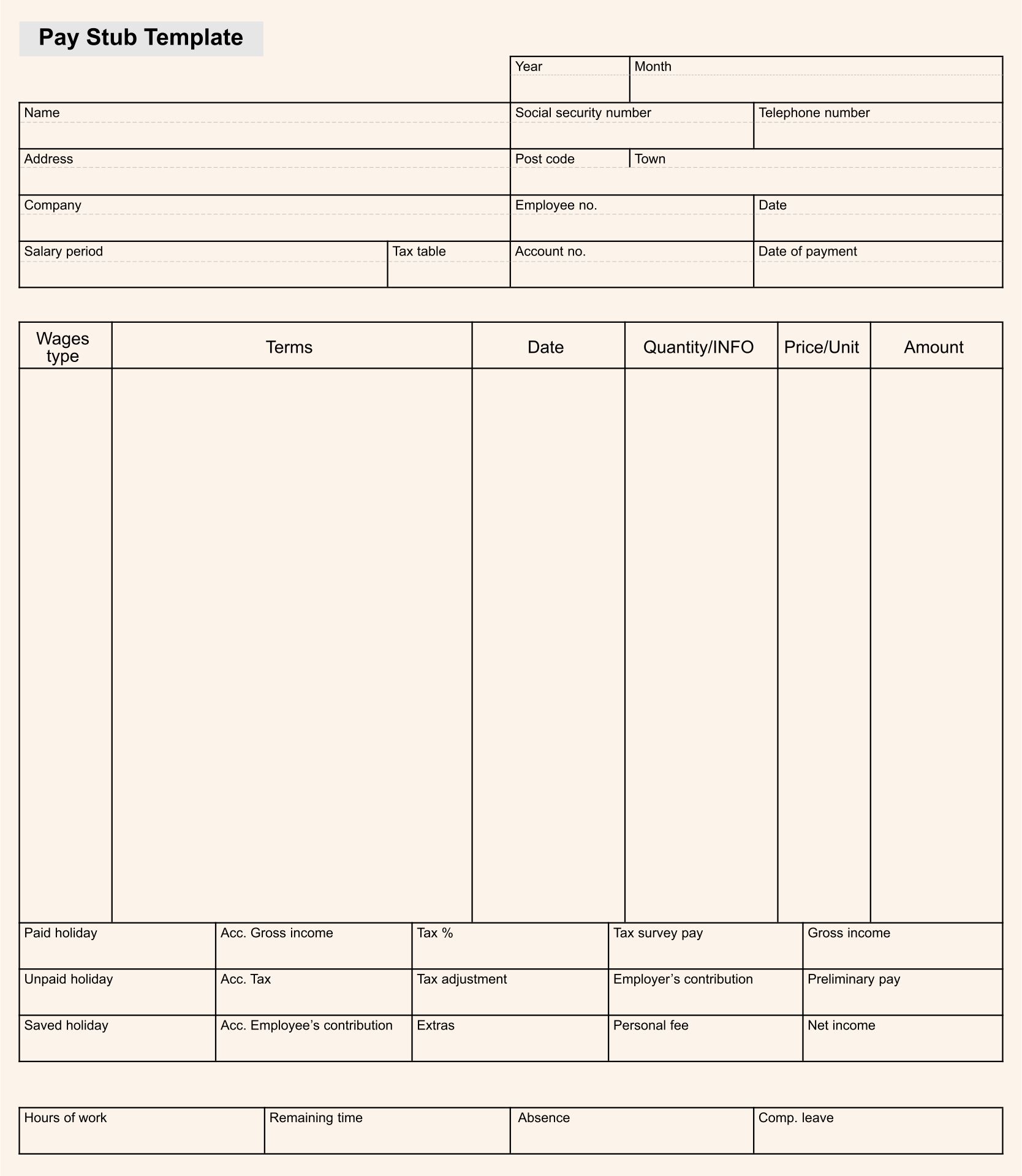

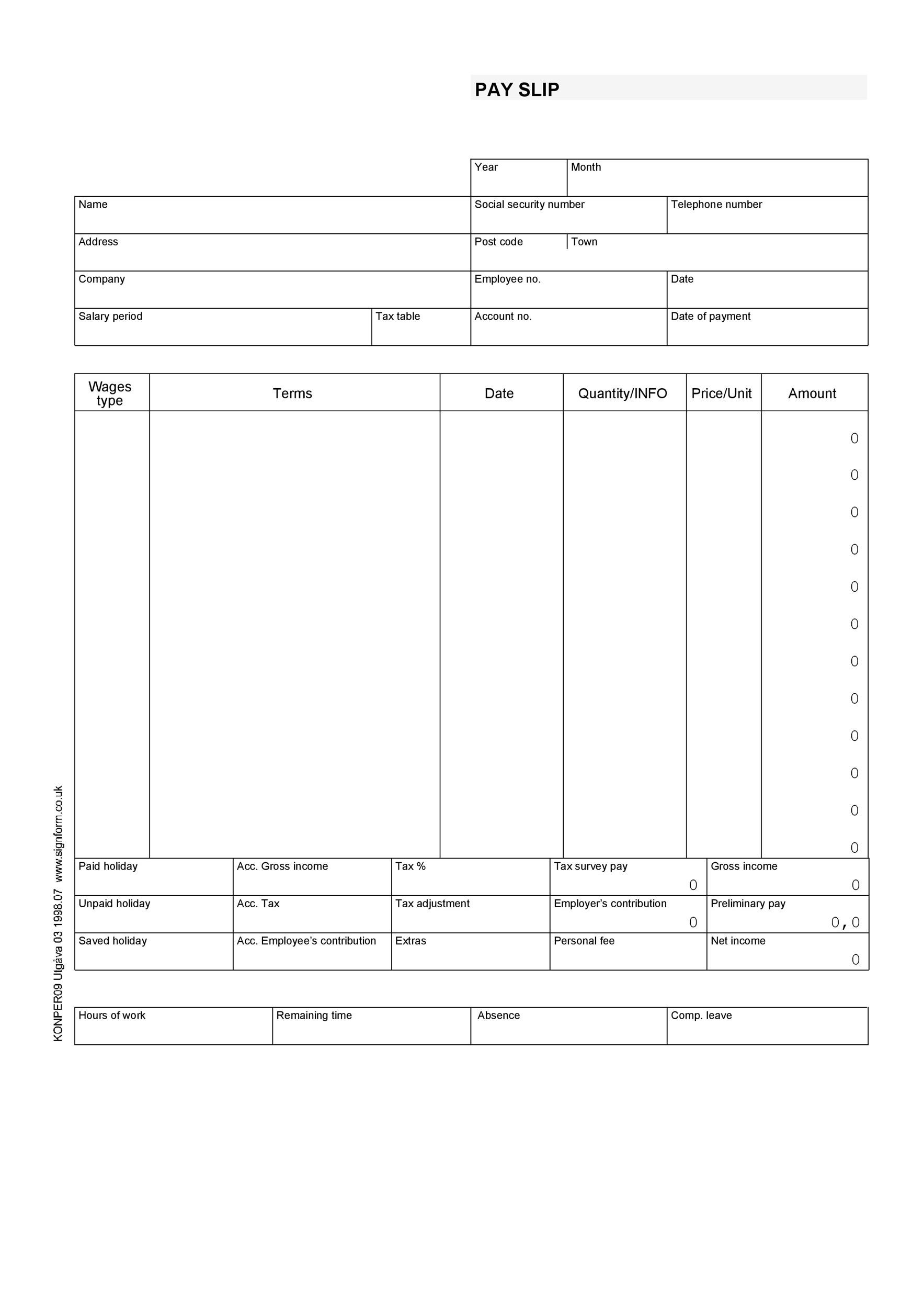

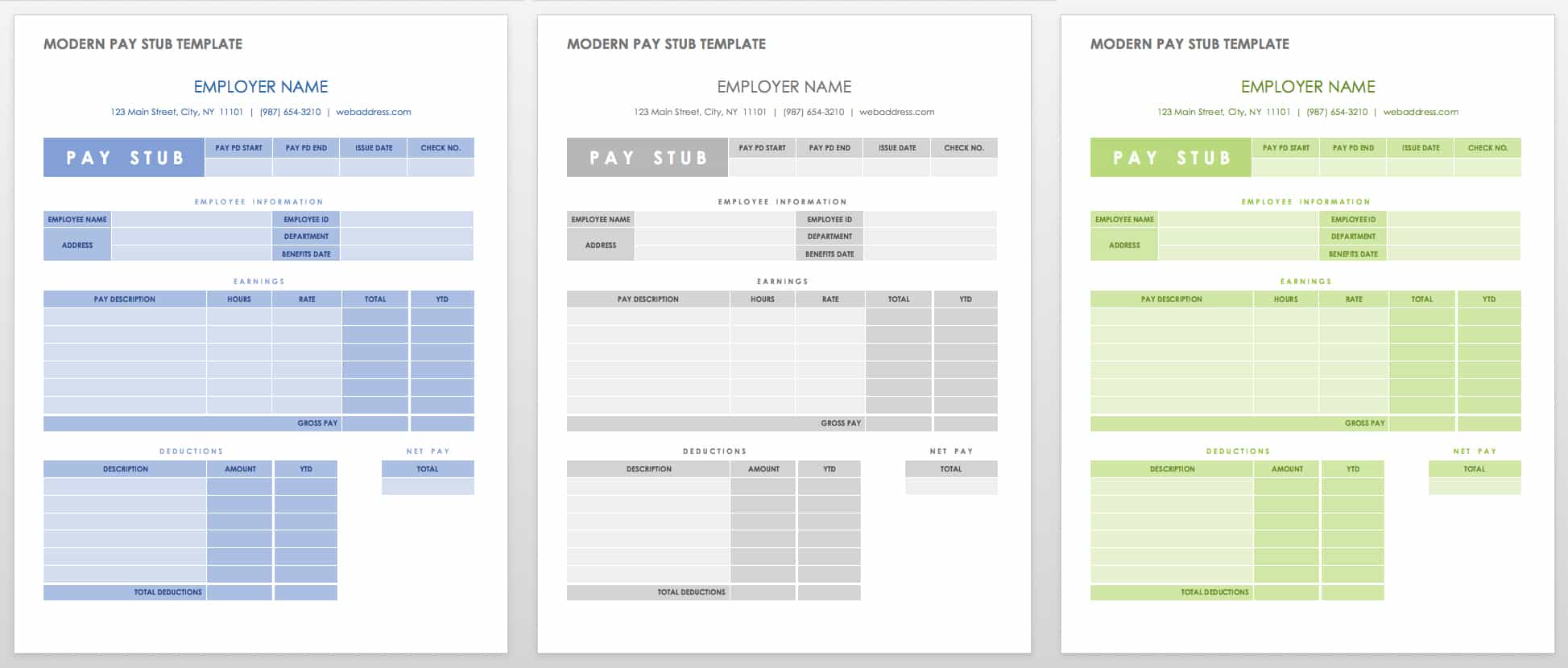

Blank Pay Stub Template Word

Although procedures might look completely different from firm to firm, you must use this blank template to develop yours. These labels measure 3/4″ x 2 1/4″ every and come 30 per 8 1/2″ x 11″ sheet. These labels measure 1 1/2″ x 2″ every and are available 25 per eight 1/2″ x 11″ sheet.

Memes today are as flexible and various as the whole web, and Kapwing is the generator that may keep tempo together with your content material. Kapwing is a strong on-line editor that you have to use to create memes from photographs, GIFs, and videos on-line. It’s one of many net’s most popular meme makers and is the primary meme generator to help movies. Kapwing has the power that you want to create precisely the meme you want, combined with the simpliciy of a on-line device. In addition to being the only meme maker that helps video, Kapwing additionally allows you to outing meme components and place them in one single, simplified interface.

Custom templates seem in the My Templates class within the template chooser. This multi-purpose presentation is simply excellent for any instructional function. It seems like a pocket book, displaying writing traces and sheets. In addition, you’ll additionally see highlights, underlined words, doodles and illustrations of stationery. The title typefaces show a hand-written type, which is in consonance with the relaxation of the template. Short Term Rental AgreementProtect the landlord and the tenant through the use of this legally-binding Short Term Rental Agreement template.